Original Medicare is a federal health insurance program for seniors and people with certain disabilities. When a Medicare recipient requires emergency care, Medicare does cover emergency room visits for the most part, and the recipient pays a copayment.

Read on to learn more about emergency room costs and how a Medicare Supplement Insurance plan can help reduce what you pay out of pocket for Medicare emergency room coverage.

Original Medicare only covers chiropractic visits for manual manipulation of the spine to correct subluxation — a displacement or misalignment of a joint or body part. After you meet your Medicare Part B deductible, you pay $0 for services covered by Original Medicare. Office visit copay may apply. For the rest of the year, Frank will owe absolutely nothing out of pocket for covered Part A & B services. His Medicare Plan G coverage takes care of the rest. His only copays will be for his medications under his separate Part D prescription drug card. This means he doesn’t have to worry about any more doctor copays. With a Medigap Plan N, there is a $20 copay for doctor’s office visits. Whether or not a copay is due, depends on the billing code used by your doctor when requesting payment under Medicare Part B. Under most circumstances the copay $20 copay is due. For a more detailed explanation visit www.cms.gov. Medicare Part B pays 80% of most doctor's services, outpatient treatments, and durable medical equipment (like oxygen or wheelchairs). You pay the other 20%. Medicare also pays for mental health.

What is the Copay for Medicare Emergency Room Coverage?

A copay is the fixed amount that you pay for covered health services after your deductible is met. In most cases, a copay is required for doctor’s visits, hospital outpatient visits, doctor’s and hospital outpatients services, and prescription drugs. Medicare copays differ from coinsurance in that they're usually a specific amount, rather than a percentage of the total cost of your care.

Medicare does cover emergency room visits. You'll pay a Medicare emergency room copay for the visit itself and a copay for each hospital service. It is important to remember, however, that your actual Medicare urgent care copay amount can vary widely, depending on the services you require and where you receive care.

If you are admitted for inpatient hospital services after an emergency room visit, Medicare Part A does help cover costs for your hospital stay. Medicare Part A does not cover emergency room visits that don't result in admission for an inpatient hospital stay.

What Does Medicare Pay for Emergency Room Visits?

Medicare Part A emergency room coverage is specifically for inpatient hospital stays. If your emergency room visit requires you to be admitted for inpatient care, your Medicare Part A benefits would kick in but are subject to the Part A deductible and coinsurance.

Most ER services are considered hospital outpatient services, which are covered by Medicare Part B.They include, but are not limited to:

- Emergency and observation services, including overnight stays in a hospital

- Diagnostic and laboratory tests

- X-rays and other radiology services

- Some medically necessary surgical procedures

- Medical supplies and equipment, like splints, crutches and casts

- Preventive and screening services

- Certain drugs that you wouldn't administer yourself

NOTE: There's an important distinction to be made between inpatient and outpatient hospital statuses. Your hospital status affects how much you pay for services. Unless your doctor has written an order to admit you as an inpatient, you're an outpatient, even if you spend the night in the hospital.

How Medicare Part B Pays For Outpatient Services

Medicare Part B pays for outpatient services like the ones listed above, under the Outpatient Prospective Payment System (OPPS). The OPPSpays hospitals a set amount of money (or payment rate) for the services they provide to Medicare beneficiaries.

The payment rate varies from hospital to hospital based on the costs associated with providing services in that area, and are adjusted for geographic wage variations.

Other Medicare Costs

Aside from Medicare ER copays, there are other outpatient hospital costs that you should be aware of when visiting the emergency room, such as deductibles and coinsurance. In most cases, if you receive care in a hospital emergency department and are covered by Medicare Part B, you'll also be responsible for:

- An annual Part B deductible of $203 (in 2021).

- A coinsurance payment of 20% of the Medicare-approved amount for most doctor’s services and medical equipment.

How You Pay For Outpatient Services

In order for your Medicare Part B coverage to kick in, you must pay the yearly Part B deductible. Once your deductible is met, Medicare pays its share and you pay yours in the form of a copay or coinsurance.

Get Help Covering Your Emergency Room Copay

If you're worried about a trip to the emergency room adding expensive and unpredictable costs to your health care budget, consider joining a Medicare Supplement Insurance (or Medigap) Plan. Medigap is private health insurance that Medicare beneficiaries can buy to cover costs that Medicare doesn't, including some copays. All Medigap plans cover at least a percentage of your Medicare Part B coinsurance or ER copay costs.

To find a Medigap plan in your area, call 1-800-995-4219 to connect with a licensed insurance agent.

Does Medicare Part A cover emergency room visits?

If you opted out of Medicare Part B, and only have Part A, you may be wondering if you can get coverage for an emergency room visit. Medicare Part A is designed for hospital insurance, meaning that it's benefits are generally used once admitted to the hospital.

Resource Center

Enter your email address and get a free guide to Medicare and Medicare Supplement Insurance.

By clicking 'Sign up now' you are agreeing to receive emails from MedicareSupplement.com.

Does Medicare Cover Doctor Visits

We've been helping people find their perfect Medicare plan for over 10 years.

Ready to find your plan?

By Kolt Legette

Since 2003, Kolt Legette has helped clients navigate the often-confusing world of insurance. His number one goal is protecting the medical and financial wellbeing of every person he speaks with, wheth .. sceler they choose to buy insurance or not. Kolt loves representing the best brands in medical insurance as it allows him to provide side-by-side comparisons for his clients. This allows the client to decide which company works best for them. By putting the needs of the client above everything else, Kolt helps real people find affordable health insurance solutions for their most pressing healthcare needs. With his belief that peace of mind is priceless, Kolt's goal in every interaction is to make sure every person he speaks to leaves with the peace of mind they rightfully deserveRead more

Generally speaking, no. This can vary a bit, depending on whether or not you have Medicare Advantage. There can also be some fees related to your doctor's visit, like prescription drug costs, that often do have a copay. We’ll go through the full structure of your out-of-pocket fees with Medicare as they relate to doctor visits, so you can know what to expect when you walk in the door.

Copay vs. Coinsurance

Copays and coinsurance fees are often discussed when you hear about your medical insurance plan. Most of the time, a copay or copayment refers to a single fee that you will have to pay when you receive health care. For example, your insurance may charge a $20 copay for each doctor visit, and you’ll have to pay this same fee no matter which services you receive at the doctor’s office.

A coinsurance functions as a percentage-based cost-sharing agreement, rather than a set fee. For example, Medicare Part B has a 20 percent coinsurance, which means that Medicare pays 80 pecent of the approved amount of your medical services, and you pay the remaining 20 percent. Some private insurance plans can have both a copay and a coinsurance for different scenarios.

Both copay and coinsurance fees will only apply after you’ve paid your annual deductible.

Does Medicare Use Copays?

Yes and no. Importantly, Part B of Medicare never uses copays. Part B has a deductible of $203per benefit period, and after this, you will pay 20 percent of your costs, which is your coinsurance. Medicare Part B covers doctor visits, as well as other things like durable medical equipment, so you will never pay a copay for a doctor visit under Original Medicare, only a coinsurance.

Mental Health Services -- The Exception

Mental health services are the one regular exception to this rule. There may be some instances in which you don't have to pay a copay for these services, but most of the time that is the arrangement that Medicare will use. Make sure to check the details with the office you are dealing with and with Medicare.

What About Part A?

Medicare Part A does not technically use a copayment, but the fees are very similar to what most people associate with copays. Part A hospital insurance uses a so-called coinsurance fee, but this fee is not percentage-based and is pre-set with a few tiers depending on the length of your skilled nursing facility or hospital stay. Because it is a pre-set fee, it does function like a copay, despite being called a coinsurance.

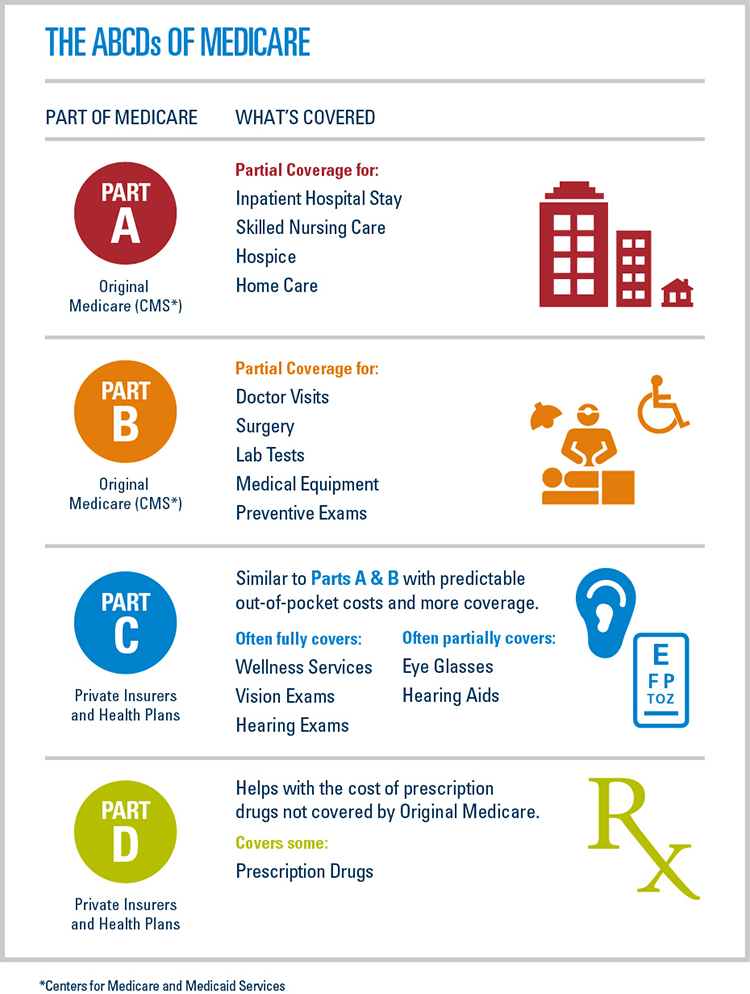

Copays with Medicare Advantage

When it comes to copays, Medicare Advantage is a whole other story. Medicare Advantage, or Part C, refers to a way of receiving your Medicare coverage through a private health insurance company. If you have a Medicare Advantage plan, many of the associated fees will be set by that insurance company, rather than Medicare. Although there are some regulations on these costs, there will be more variety.

This means that some Medicare Advantage plans will have copays, and others won’t. The amount of the copay will vary, and some plans may use copays for one type of care while using a coinsurance for others; it depends. If you have a Medicare Advantage plan, make sure that you know in advance what the copay is, so you can be prepared when you go see your healthcare provider.

How do Part D Prescription Drug Plans Fit In?

Although Part D plans usually won't apply to your actual doctor visit, they are still very relevant to the process. If your doctor prescribes you medication during your visit, it will usually be covered by a Part D plan. For this reason, you should make sure to understand the copay structure and out-of-pocket fees associated with your prescription drug plan, whether it’s Part D or another private plan.

Like Medicare Advantage plans, Part D plans are offered by private insurance companies. This means that they are also free to use copays, and the majority will. Prescription drug coverage is especially suited to copay structures since people refill their prescriptions often. If you have a Part D plan, it most likely uses a copay.

When it comes to Part D plans, there will usually be a tier list that has a higher copay for drugs higher on the list. Watch dogs xbox 360 torrent. If possible, try to know what the copay is before you go in to get your prescription filled.

Can Medigap Plans Help?

Medicare Office Visit Cost

Medigap plans, or Medicare Supplement Plans, are plans that cover some of your Medicare out-of-pocket costs. With these plans, you will only pay a monthly premium, with no other out-of-pocket costs. As an example, these plans can cover your Part B coinsurance, and cover many other out-of-pocket fee categories. You can read more about Medigap plans at medicare.gov.

Medigap plans only cover out-of-pocket costs, so they won’t cover medical services. These plans only cover Original Medicare, not Medicare Advantage or Part D drug plans.

Because they don’t cover Medicare Advantage, Medigap plans won’t ever be able to pay for your copay. This is simply because there is no usual copay under Original Medicare. Some Medigap plans will cover the Part A coinsurance, which as we mentioned earlier, does function the same way as a copay.

Things to Keep in Mind

Overall, understanding copays with Medicare is simple, just don’t ignore it until the last minute! If you have a Medicare Advantage plan, make sure that you understand your out-of-pocket fees so a copay won’t surprise you. Otherwise, you'll rarely have to deal with copays with Medicare.

Related Articles

Please enable JavaScript to view the powered by Disqus.

Please enable JavaScript to view the powered by Disqus.